The federal government has eased the eligibility requirements for the Canada Emergency Business Account (CEBA) just days after small business owners criticised its strict application guidelines.

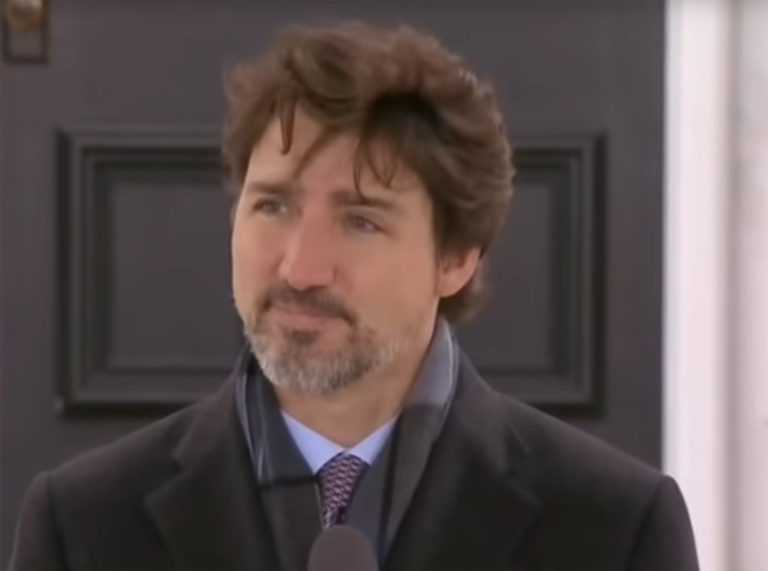

On Thursday, Prime Minister Justin Trudeau announced that businesses which paid between $20,000 and $1.5-million in total payroll last year will now be eligible for the program. Previously, only businesses with between $50,000 and $1-million in payroll were eligible.

The change was one of two announcements focused on helping small business owners during the COVID-19 pandemic. The second was about plans to create a Canada Emergency Commercial Rental Assistance program to provide loans to property owners who lower or forego the rent small businesses pay as tenants. The program will be applied for rent payments made for April, May and June.

“As things evolve, we’re hearing from Canadians who need more help (and) from businesses who need more support,” Trudeau said during a media briefing Thursday morning. “No one should feel as if they’re alone in this fight. Our government is here to help you through these challenging times, so when we hear a program is not reaching as many people as it should, we make changes.”

While organizations like the Canadian Federation of Independent Business (CFIB) welcomed the creation of the CEBA on April 9. However, they argued that the payroll requirements left out too many “mom and pop” type shops, as well as sole proprietors.

On Thursday, the organization once again welcomed the government’s decision to relax some restrictions, but also argued they didn’t go far enough.

“It’s clear that the government has been listening to the concerns raised by CFIB and small business owners across the country with today’s significant change to CEBA,” read a joint statement from CFIB president Dan Kelly and executive vice-president Laura Jones. “Reducing the wage floor from $50,000 to $20,000 and raising the ceiling from $1-million to $1.5-million will allow thousands of additional small firms to access this important program. Still, brand new firms, the self-employed and those that pay with dividends only will remain excluded from CEBA.”

The CFIB says roughly 80 per cent of small businesses are completely or partially shut down, and 50 per cent of small businesses report they may not survive if current restrictions continue to the end of May. Both Kelly and Jones added that it’s not enough to simply defer payments, since businesses will simply go bankrupt as soon as those bills come due.

They also want provincial governments to offer more financial support as well, something that hasn’t happened outside of a few select provinces.

“Other than Saskatchewan and Nova Scotia, provincial governments have been slow to come to the table to offer support with rent despite the fact that it is provincial governments that have ordered most SMEs (small or medium-sized enterprises) to close,” they wrote.

The federal Conservatives also welcomed the changes, but criticized the government for taking so long to make them.

Dan Albas, the Conservative shadow minister for Employment, Workforce Development and Disability Inclusion, said the government quickly created programs, but struggled to make them available to those who need them most.

“Government communications and direction must be clear, consistent and transparent,” he said in a media release. “That has not been the case during this crisis.”

Albas added that late changes to the CEBA show the importance of continued in-person sitting in the House of Commons, and regular opportunities to question the Prime Minster and his cabinet.

“Without that opportunity to question the Minster, Canadians would have much less information and much less accountability,” he said. “Parliament must continue to have in-person sittings so that Opposition parties can debate, discuss and improve government legislation to get the best results for Canadians.”

The CEBA allows businesses to apply for a $40,000 bank loan backed by the federal government. The loans are interest-free, and partially refundable if repaid by the end of 2020. Since the launch on April 9, financial institutions have approved more than 195,000 loans, extending more than $7.5-billion in credit to small businesses.