It was only 8 months ago that COVID-19 was becoming a reality. Much was unknown but something in the air (no pun intended) told us that life as we knew it was about to change. Denial was quickly changing to anxiety and fear. This fear was quickly evident in our capital markets as the sellers came in and stock markets at home, and around the world, dropped into bear territory in record time. The news-makers were eager (dare I say gleeful) to tell everyone that we were in a recession with no end in sight.

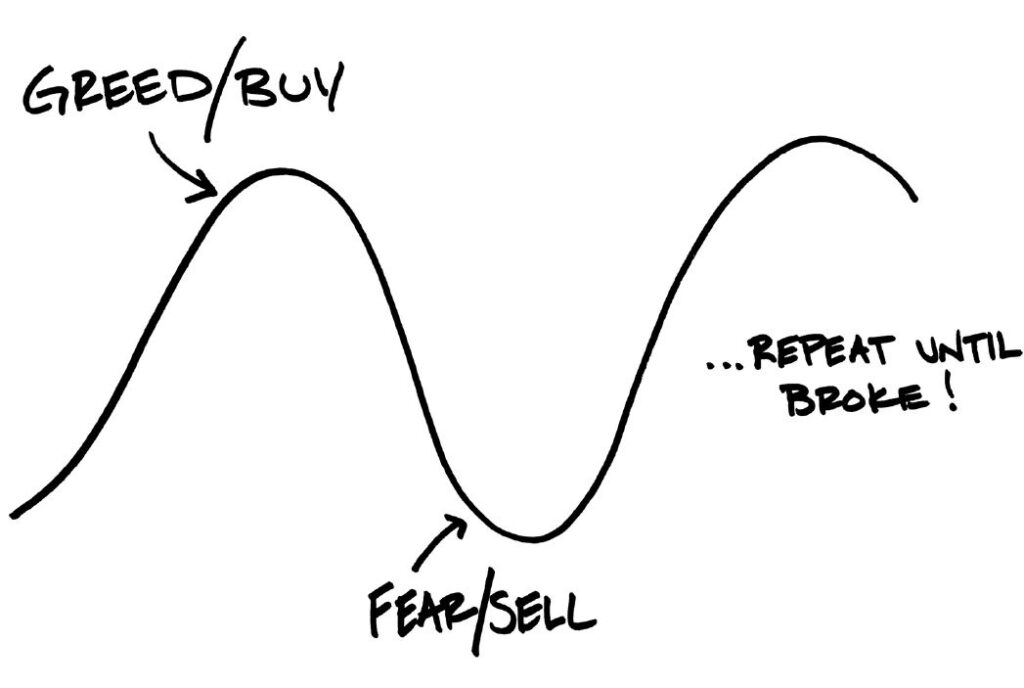

True, it was a time of great uncertainty, and if an investor decided that they’d had enough and that they were getting out of the market to wait for the DUST to SETTLE, that was understandable. Not a wise decision, but understandable. Emotions were running high as we were facing something that no one alive today had ever experienced.

As in the past, the market has provided a lot of teachable moments this year. Near the top of that list is that timing the market is not a requirement for successful investing. In fact, the opposite is true. Part of being a good investor requires you to just sit there when every instinct in your body is telling you to do something.

It is said that a picture is worth a thousand words and the following graph is no exception. It tells a story that is all too real; however, there is a silver lining in that it is the irrational decisions of the emotional investor that is the friend of the investor who does not act on emotion. The truism of ‘one man’s trash is another man’s treasure’ is never more reflective than in the stock market.

It has been a long 8 months and it has been a stressful time for all, albeit more so for some than others; however, the good news is that the light at the end of the tunnel is not a train. We have every reason for optimism as we now know the results from the United States election, and we now know that we will soon have a vaccine against the virus. Stock markets, although already having made impressive gains from the lows of March 21st, have celebrated with impressive gains in recent weeks.

If your investment strategy was to exit the market and ‘wait for the dust to settle’, I would ask at what point in the last 8 months did you get back in? If you are still waiting for the dust to settle, you will most likely spend the rest of your life in this search. If our capital markets have taught us one lesson throughout the past 100 years, it’s that there is always dust and it never, ever settles. Embrace the dust. It is your friend.

If you have questions about your investments, or if you’d like to better understand how the stock market works, please let us know and we’d be happy to help you. It’s never too late to find an advisor and start planning for your future.